IRS Instructions 8962 2024-2026 free printable template

Show details

Instructions for Form 8962 Premium Tax Credit PTC Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8962 and its instructions such as legislation enacted after they were published go to IRS.gov/ Form8962. Reminders New employer-coverage affordability rule for family members of employees. For tax years beginning after December 31 2022 for purposes of determining eligibility for the PTC...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 8962 instructions

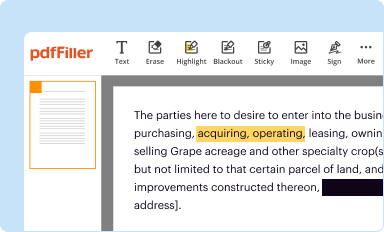

Edit your form 8962 instructions 2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

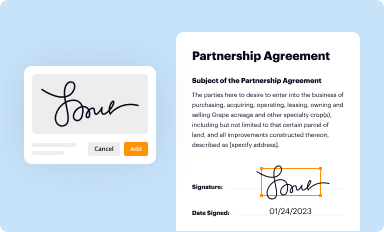

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form instructions 8962 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

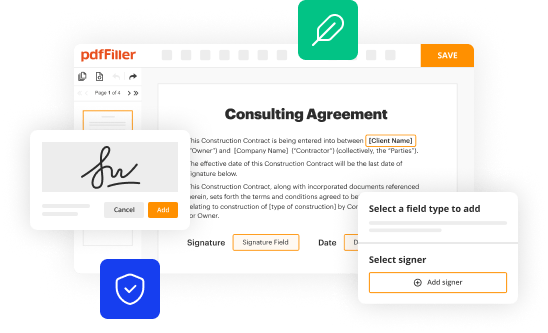

Editing 8962 instructions online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 8962 instructions pdf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 8962 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 8962 instructions 2024 form

How to fill out IRS Instructions 8962

01

Obtain IRS Form 8962 and the accompanying instructions from the IRS website.

02

Ensure you have your Form 1095-A, Health Insurance Marketplace Statement, which provides information about your health coverage.

03

Fill out Part I of Form 8962 to report your annual and monthly premium tax credit.

04

Complete Part II to calculate your premium tax credit based on the information provided in Form 1095-A.

05

If you need to reconcile or make adjustments, fill out Part III to report any changes in your coverage.

06

Double-check all calculations to ensure accuracy.

07

Attach Form 8962 to your tax return when filing.

Who needs IRS Instructions 8962?

01

Individuals who received premium tax credits through the Health Insurance Marketplace.

02

Taxpayers who need to reconcile advance premium tax credits with the actual premium tax credit they qualify for.

03

People who have filed taxes for a year in which they had marketplace coverage.

Fill

how to fill out form 8962 step by step

: Try Risk Free

People Also Ask about form 8962 instructions

What is form 8962 used to calculate?

Purpose of Form Use Form 8962 to figure the amount of your premium tax credit (PTC) and reconcile it with advance payment of the premium tax credit (APTC).

What does the e file database indicates that Form 8962?

IRS implemented this check for taxpayers who received the Premium Tax Credit payments during the year, and must add form 8962 to the return to reconcile the payments received against the credit calculated and either pay back or get an additional refund.

Why is the IRS asking me for form 8962?

When the Health Insurance Marketplace pays advance payments of the premium tax credit on your behalf, you must file Form 8962 to reconcile the advance payments to the actual amount of the Premium Tax Credit that you are eligible for based on your actual household income and family size.

Where do I put 8962 on my 1040?

Enter your excess advance premium tax credit repayment on line 29. Write the smaller of either line 27 or line 28 on line 29, and on your Form 1040 or 1040NR. That's the amount you owe in repayment for getting more than your fair share in advance payment of the PTC.

What is Form 8862?

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in irs form 8962 instructions 2024 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing instructions for form 8962 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the how to fill out 8962 form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your irs form 8962 for in seconds.

How can I fill out 2024 form 8962 instructions on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 8962 instructions from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IRS Instructions 8962?

IRS Instructions 8962 provide guidance on how to complete Form 8962, which is used to calculate the premium tax credit for individuals who purchased health insurance through the Health Insurance Marketplace.

Who is required to file IRS Instructions 8962?

Taxpayers who wish to claim the premium tax credit and those who received premium tax credits through the Health Insurance Marketplace must file IRS Instructions 8962.

How to fill out IRS Instructions 8962?

To fill out IRS Instructions 8962, taxpayers should gather information from their Form 1095-A, use the provided worksheets to calculate their premium tax credit, and then complete Form 8962 according to the instructions provided.

What is the purpose of IRS Instructions 8962?

The purpose of IRS Instructions 8962 is to provide clear directions on how to accurately complete Form 8962 to determine eligibility and calculate the premium tax credit for health insurance coverage.

What information must be reported on IRS Instructions 8962?

IRS Instructions 8962 require taxpayers to report information such as the amount of premium tax credits received, household income, and the number of months coverage was held during the tax year.

Fill out your IRS Instructions 8962 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 8962 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to form 8962 instructions for

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.